Articles

FCNR Places are entirely and freely repatriable meaning that you is posting both dominant number and also the desire gained on the overseas bank account with no restriction and you may taxes. The newest FCNR dumps are one of the safest and more than safe funding choices within the Asia to have NRIs. (e) Accept interest-totally free put aside from in the newest account or pay compensation indirectly. (e) Zero charges might be levied in the case of early conversion process out of stability held in the FCNR (B) deposits to your RFC Accounts because of the Low-Citizen Indians to their come back to Asia. (d) Scheduled Commercial Banks shall, from the the discernment, levy penalty to recuperate the newest swap costs when it comes to untimely detachment away from FCNR(B) deposits.

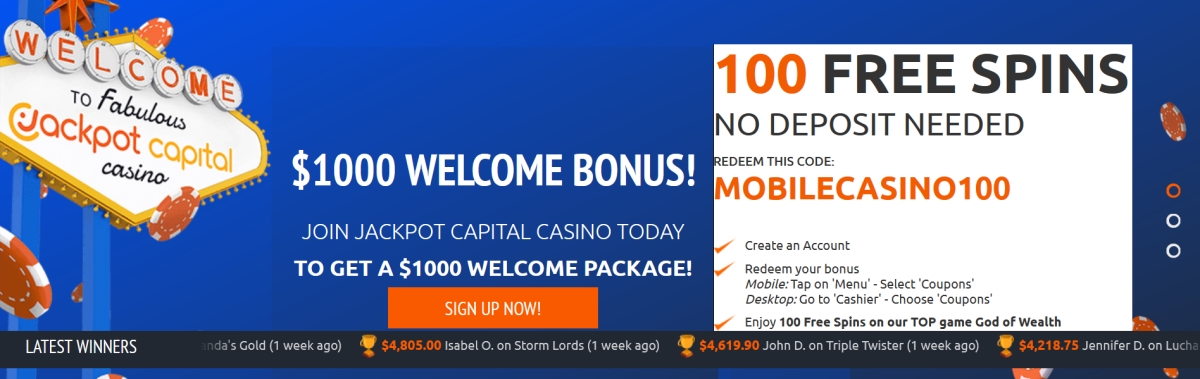

Section cuatro Withholding Requirements: jackpot strike casino uk login

Labeled as one of the most of use All of us banks to deal having, Funding You’re also very technical-centered. This makes it a choice if you would like to bank on the internet and on the mobile phone, and making use of digital devices. HSBC is actually a major international bank, so it’s one of the best alternatives for expats looking to rating install within the a new country. TAS makes it possible to take care of problems that your retreat’t was able to care for to the Irs yourself.

And that as well try a highly more sensible choice compared to the regional financial institutions abroad. On the final portion let’s stop as to the reasons NRI Fixed Put is among the finest mediums to have investment within the India and you may promoting tax-free offers. Almost every big financial within the India will give the benefit out of calculating the Return on investment (ROI) in the event of an enthusiastic NRI Fixed Deposit. SBNRI too can make suggestions from earliest computation from production based on the opportunities and certainly will and recommend about how to maximize these efficiency that have a robust backup of highly educated someone.

Tips open a keen FCNR Put Account?

If you don’t has cause jackpot strike casino uk login to trust or even, you may also rely upon the fresh written statement of the person called to the earnings from what amount of get. The proper execution W-8 or documentary evidence need to inform you the fresh helpful customer’s base within the the house providing go up to your get. Certain desire obtained out of a residential company that’s an existing 80/20 company is not susceptible to withholding. A current 80/20 company must fulfill all of the following standards. An excess introduction used on next foreign people must be utilized in one individuals earnings meanwhile while the other income on the organization is roofed inside money. Desire to your such as debt isn’t an excellent withholdable payment below part cuatro, but when the tool are materially altered immediately after March 18, 2012.

Restrict Earnings

Have fun with Income Password 43 to help you report money to artists and you will athletes with finalized a CWA. This category is provided with an alternative income code amount while the particular income tax treaties excused an instructor away from tax to own a small count out of ages. Buy exercises setting payments so you can a great nonresident alien teacher, professor, otherwise researcher by a great U.S. university or any other licensed educational establishment to have exercises or look functions at the business. Payment paid for functions did inside the Puerto Rico by the a good nonresident alien who is a citizen out of Puerto Rico for a manager (apart from the us otherwise one of the companies) isn’t at the mercy of withholding.

When comparing all of our prices so you can to your-university prices you should take into consideration of numerous variables, and flooring bundle build, square footage, furniture, utilities and neighborhood situations. Our very own local rental staff is available to discuss along with you exactly how all of our cost compare with other property options and you may verify our community offers you value to suit your currency, and a venue and you may incredible services. A low-Citizen Ordinary (NRO) account is a savings account that’s beneficial when you yourself have income within the Asia. You can deposit Indian earnings – away from returns, collateral output, pension, rentals, or other money – to your an NRO membership.

So you can qualify for the first Financial scheme, potential homeowners have to meet specific requirements established by government. This type of conditions are created to make sure the advice has reached those who its want it if you are creating responsible financing techniques. When you are a property manager, you will need to discover their legal rights and you can obligations about your deposit.

Having a great 5% deposit, you’re also borrowing from the bank 95% of the house’s well worth, and therefore presents far more chance to help you lenders. (1) Private privacy comes with renting, treatment, written and you may mobile communication, individual care, check outs, and meetings away from family and you will resident teams, however, this does not require the business to incorporate a personal place for each and every resident. (v) The fresh terms of a solution bargain from the or for just one seeking admission to your facility should not argument with the requirements of such regulations.

To find out more, see Penalties in the current-12 months modify of your Recommendations to have Mode 1042-S. A penalty could be implemented to possess inability to help you file Mode 8805 whenever owed (in addition to extensions) and inability to include complete and you will proper guidance. The degree of the fresh punishment depends on when you file a great best Function 8805. The newest punishment for every Mode 8805 is generally exactly like the newest penalty to possess perhaps not filing Setting 1042-S. The connection will get reduce the overseas partner’s show of partnership terrible ECI because of the following the.

- (i) Blog post within the a location readily open to residents, and you may members of the family and you can judge agencies away from owners, the outcomes of the very most recent questionnaire of your own business.

- Including, you might use an application W-8BEN-E to find both chapter step 3 and you can chapter 4 statuses from an entity offering the mode.

- Plus the guidance that is required for the Setting 1042, the fresh WT need mount a statement demonstrating the new levels of any over- or less than-withholding modifications and you may a reason of those alterations.

- A collaboration needed to withhold lower than part 1446(f)(4) have to report and you can spend the money for tax withheld having fun with Versions 8288 and you may 8288-C.

- Rather, a great payee is generally permitted treaty professionals beneath the payer’s pact if there’s a provision for the reason that pact you to definitely is applicable especially in order to attention paid back from the payer overseas company.

But not, the fresh element of a grant or fellowship paid back to help you a good nonresident alien that doesn’t create a qualified grant are reportable to the Mode 1042-S that is susceptible to withholding. Including, those people parts of a scholarship centered on travel, room, and you will panel is actually susceptible to withholding and therefore are claimed to the Mode 1042-S. The brand new withholding price is 14% on the nonexempt grant and you may fellowship offers paid to help you nonresident aliens briefly contained in the us inside the “F,” “J,” “Meters,” or “Q” nonimmigrant condition. Repayments built to nonresident alien someone in every almost every other immigration condition try susceptible to 29% withholding. Dividends repaid by a different corporation aren’t subject to section step three withholding and therefore are perhaps not withholdable costs. But not, a questionnaire W-8 may be needed to have reason for Function 1099 reporting and you will backup withholding.

- For the reason that the brand new exception can be centered things you to can not be determined up until pursuing the stop of the year.

- NRIs need to pay taxation as per the Indian income tax legislation in the nation to your all the income produced within the India.

- The lending company keeps the desire, plus the landlord and you can citizen get nothing in return.

- A. Most of the time, a property manager usually do not charges multiple month’s lease because the a safety put.

Whether or not a price realized is actually paid to a great transferor away from a PTP desire thanks to a brokerage, a brokerage is not required to keep back below part 1446(f) if it could possibly get believe in a professional notice regarding the PTP you to claims the newest usefulness of the “10% exception” in order to withholding. See Legislation part step 1.1446(f)-4(b)(3) for additional information on it exclusion, and that applies to an excellent PTP with lower than 10% effectively linked gain (otherwise which is if not maybe not involved with a trade otherwise team in the us). In the event the lots was not tasked by the due date of your very first withholding tax payment, the relationship is to go into the time the number was applied to possess for the Mode 8813 when designing the commission. When the partnership receives its EIN, it will instantaneously offer one number for the Internal revenue service. The partnership, otherwise an excellent withholding representative to your connection, need to pay the new withholding tax. A partnership that have to spend the money for withholding taxation but does not exercise could be liable for the fresh percentage of the taxation and people punishment and attention.

You can also have to remove the new organization while the a great flow-thanks to entity underneath the presumption legislation, chatted about after. An excellent U.S. partnership would be to keep back when any withdrawals that come with quantity at the mercy of withholding are built. While we can be’t act myself to every remark acquired, we perform enjoy your own feedback and certainly will consider your statements and you will guidance even as we update our very own taxation models, instructions, and you will books. Don’t posting tax issues, tax returns, otherwise costs to your more than address.

All U.S. and you can foreign withholding agent that is required so you can file a form 1042-S should also file an annual return on the Setting 1042. You should document Mode 1042 even although you weren’t required so you can withhold one tax less than chapter step three to your fee, or if perhaps the new percentage try a chapter cuatro reportable matter. A different company that’s an income tax-excused team under area 501(c) is not susceptible to a good withholding taxation to the amounts which might be perhaps not income includible lower than section 512 since the unrelated company taxable earnings. As well, withholdable repayments made to a taxation-exempt organization below point 501(c) are not money to which chapter 4 withholding can be applied. If you are men guilty of withholding, accounting to have, or depositing or investing employment taxes, and you may willfully fail to do it, you will be kept accountable for a punishment comparable to the new complete number of the fresh unpaid trust fund tax, in addition to attention. An accountable individual for this specific purpose will be a police away from a corporation, somebody, a sole manager, otherwise a worker of any form of organization.

If you learn you overwithheld taxation under section 3 or cuatro by the February 15 of your following the calendar year, you might use the new undeposited amount of taxation and make people necessary modifications ranging from you and the new individual of your money. But not, if your undeposited number isn’t sufficient to make any alterations, or if you find the overwithholding following whole number of income tax has been placed, you can utilize sometimes the new reimbursement processes or even the put-out of procedure to regulate the fresh overwithholding. The amount of tax you have to keep back establishes the brand new volume of one’s deposits. To find out more, discover Deposit Criteria on the Guidelines to have Mode 1042. In initial deposit needed for one months occurring within the step 1 calendar year have to be generated separately from a deposit the several months going on in another calendar year.